Just about four months ago roughly 143 million people – pretty much every adult in the USA – fell victim to Equifax’s lax handling of highly sensitive personal information. While the initial outrage lasted in the media, everybody was eagerly trying to protect what they could – but by now it’s eerily quiet out there.

It’s not over, though. It will never be over. For the rest of your life you will have to watch your credit file, not just with Equifax, but with all three reporting agencies. Good for you, if you placed a security freeze on your credit file with every one of the bureaus. Once your accounts are “frozen”, identity thieves will have to find your PIN code to “unfreeze” them before they can cause you harm.

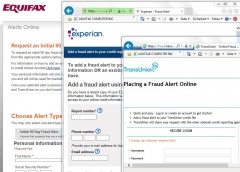

Now, these credit reporting agencies are not in the business of making your life easier, so they try hard to hide the place where you need to go to fill out their fraud alert form. I bookmarked those links for you, though. You’re welcome.

Equifax fraud alert

Experian fraud alert

Transunion fraud alert

The comments are closed.